September 2015

Marin Market Update

A look at how the international economy, mortgage rates, the moods of today's buyers and sellers and local market issues affect Marin Real Estate.

Well, we made it through summer vacations, got everyone back to school, and are ourselves now getting back into the work groove. For those watching the real estate market, we can safely declare that the Fall selling season is upon us. Sellers who’ve been waiting until after Labor Day are poised to put their properties on the market and we expect plenty of increased inventory for Marin County in the coming weeks. Buyers, start your engines!

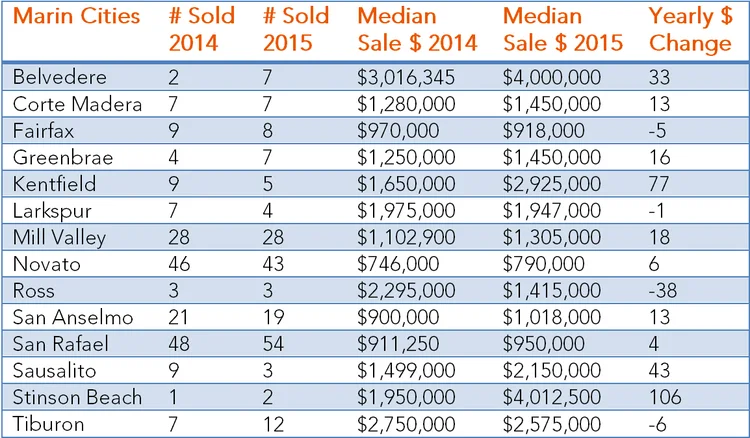

This past summer 887 homes sold in Marin from June through August as compared with 939 last year. August prices for Marin real estate ranged from $110,250 to $2,175,000 for condominiums – and $390,000 to $47,500,000 (a record setting estate in Belvedere) for single family homes, with a median single family home sale price of $1,085,000 (compared with $960,000 last August).

Who exactly is buying in Marin these days? The spectrum is broad: young families priced out of San Francisco; downsizers who are tired of caring for their large homes; upsizers who are realizing they can get a good price for their current home and find a larger home for their growing family, and; investors who are also looking to cash in on fixers or buyers who are eager to invest in a project. We’re living in a very prosperous time in a very prosperous area. The Bay Area is a global wealth center and that means demand for housing will not be slowing down anytime soon.

The current real estate market is complex. Many are wondering: how long mortgage rates will stay low? Will housing prices start to stabilize or even drop? When will all this happen? The stock market has been volatile. There are questions about the global economy and how that will affect Marin County. Some would-be cash buyers, especially at the higher end, will likely wait and see what happens. But, for many who are thinking about a home purchase with financing, now is a great time to buy.

Sellers, too, need to be aware of the myriad of changing market conditions.

Most economists were predicting the Federal Reserve would start raising rates this fall as the economy shows signs of improvement, but are now talking about a continued easing policy. In other words, low rates should stick around longer.

Low mortgage rates increase affordability. The lower the rates are, the more buyers are willing to spend on a house. Low mortgage rates also drive investors into the housing market since they can leverage their money and earn positive cash flow on rent. Bottom line: low mortgage rates stimulate high housing valuations.

The August jobs report showed unemployment rate falling to a seven year low. With this news, the Fed may announce on September 17 it will begin moving interest rates higher. The only thing that would hold it back is uncertainty about the global economy and the U.S. market volatility. Even so, many believe if there is a rate hike it would be only a quarter percent. The impact to Marin real estate? It might possibly create a sense of urgency with the sellers who feel that any increase in interest rates could mean less buying power and potentially lower prices.

Foreign investors, especially Chinese investors, are very active in high-demand markets in places like New York, London and Sydney, and yes, Silicon Valley, San Francisco and Marin County. Chinese investors looking for alternatives to their country's crashing stock market and the devaluation of their currency now account for 25% of all real estate purchases made by foreigners in the US -- a record high at $29 billion in the 12 months to March 30 according to the National Association of Realtors.

Some of U.S. consumers – those who lost their homes to foreclosures or short-sales during the real estate downturn in 2008 Recession – are also back. It generally takes seven years for a foreclosure to drop off a credit report, and these “boomerang buyers” are reclaiming their credit scores and many are ready to buy. Nearly 700,000 of the 7.3 million homeowners who went through foreclosure or short sales during the bust have the potential to get a mortgage again this year. Experts say these boomerang buyers will be an important segment of the real estate market in the coming years.

And, with equity back, those who were able to make their mortgage payments through the rough economic downturn have been rewarded by rising home prices. Millions are experiencing significant equity increases in their homes, allowing them to sell in this current market and trade up for their next purchase. Overall, that can trigger more homes on the market for first-time buyers.

Renters, too, are thinking now could be a good time to buy. With rental rates skyrocketing in the Bay Area, many renters are realizing that the cost of home ownership is lower than renewing a lease. On average in the second quarter of 2015, homeowners in the U.S. devoted 15% of their income to mortgage, whereas experts say 33% is a comfortable number. Some people living in rentals in the Bay Area devote as much as 50% of their average income on housing.

Demand for Marin real estate in the coming year will also be fueled by the new high speed rail system Smart Train, as well as a continued influx of life sciences and biotech companies into the North Bay. Home values in key areas near the train route and the work centers in San Rafael and Novato are expected to thrive.

Also of interest to Marin home buyers and sellers are continued adoptions by local municipalities to disclose and correct sewer lateral issues prior to the sale of real property. The Marin Association of Realtors has outlined an overall disclosure for consumers to be sure they are complying with local regulations. With all parties aware up front there will be less potential for delays in closings.

Additionally, city inspectors throughout Marin are paying much closer attention to decks and balconies, holding them to higher health/safety standards than in the past, following the recent the deck collapse and fatalities in Berkeley.

For those following the technical aspects of escrows in California, new lending regulations take effect on October 1st and are meant to simplify the reports generated at the end of escrow to clearly show where all proceeds go and to whom. The new forms and disclosures call for ample time to be given for review of files and any changes in the original contract such as credits, accommodations or prices changes. Attorneys who work closely with the National Association of Realtors® have recommended as conservative advice to build into your escrows an extra 15 days for closings. If for example, you had expected a 30 day closing, now plan for a 45-day escrow as a precautionary measure.

So, that's it for the September report. Lots going on, lots to look forward to and lots to observe in this exciting market. We look forward to sharing more with you about Marin Real estate in October.

Please connect with The Costa Group to learn more about home values and current real estate opportunities in Marin County.