Image credits: VisitMarin.org

Well, it's happened! The market finally matches the weather this July; at this writing both the outside temperatures and the Marin real estate market are in the midst of a summer's heat wave! Just when you think everyone's away in Tahoe, the market remains scorching hot with activity. Marin's median price charted at $1,144,500 this past June (Median price is the point at which half of the sales are above and half are below), up 4.3% from last June which was at $1,097,000 and up 6.2 from Q1 of 2017. April showed the highest median price this year at $1,325,000, but the median has been teetering over the $1.1 million mark since December.

More inventory would certainly be helpful for those desperate buyers looking to get into a home before the new school year begins at the end of Summer. Demand continued to outpace supply with just 348 homes on the market in all of Marin.

Marin Housing Inventory 2005 through 2017

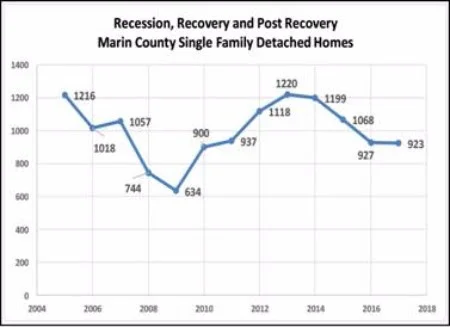

We've had a nice run here in Marin, and the market is showing no signs of slowing. In California, and in particular the Bay Area, we have had a healthy real estate market, even before the overall U.S. economy showed signs of improving, but we know at some point the market will slow and encounter more ups and downs. Uniquely, in Marin, it's really a supply and demand equation, always has been. Slow- to no-growth keeps Marin prices inflated and keeps Marin property values high.

So, why haven't more homeowners jumped into this robust seller's market? In part, because of the high number of homes that were purchased as rentals, or that have become rentals over time. With rents as high as they are, many owners are holding on to their investments as they are providing them with a nice monthly return.

And, for those not considering renting, it's a catch 22. Homeowners are afraid that, because of the inventory shortage, if they sell, they may not be able to find a replacement property. Where would they go? And, with a new tax base, the numbers just don't make sense.

But, for those of you who are ready to put your home on the market, consider each of these strategies below when trying to determine the value of your property for sale. First and foremost, talk to a licensed real estate professional and ask them to run a CMA for you (Comparative Market Analysis). This will show you similar properties in your near vicinity and for how much they sold. From there you add dollars for the more positive attributes, and subtract for the less positive attributes. It's not an exact science, but when you know everyone is looking at the same "comps" you really can't stray too far from the projected market value.

Here are a few pricing strategies that help you refine where you want to price once you have an idea of the range in which your home sits:

- Strategy 1: Make no improvements on your property and let the chips fall where they may; price low -- attract investors and builders and first-time DIY homeowners. Under price and see where it goes.

- Strategy 2: Picture perfect and move-in ready -- a bit easier for a busy family or household to envision their new life. If it looks livable, it's definitely a plus for those buyers who don't want to bother with any immediate improvements. Price moderately as close to market value as you can.

- Strategy 3: All the bells and whistles that today's buyers want, appealing to the younger buyers with more money who want convenience, amenities and current upgrades. Price higher, but within reason --even status-conscious buyers have their limitations.

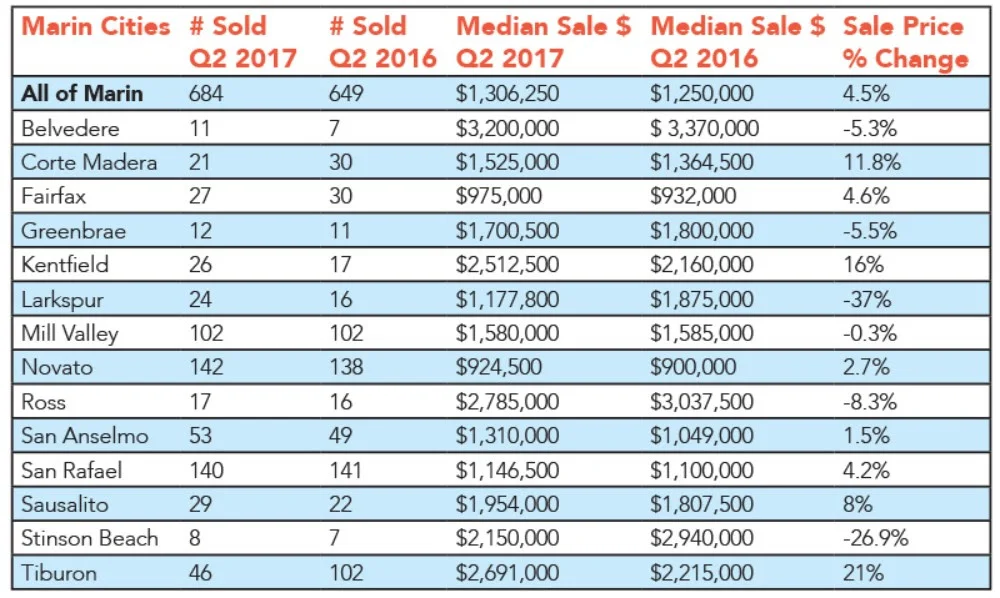

City by City Breakdown of Median Sales Price July 2017 vs. July 2016

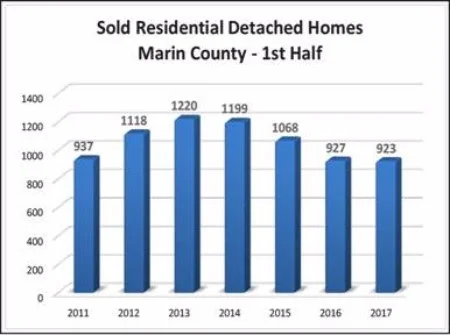

While there were seemingly fewer homes on the market (923 vs. 927 same time last year), some markets and market segments were hotter than others. Corte Madera, with more sales on the West side of the 101 (usually a bit pricier), rose by almost 12%. Marin's high-end waterfront market of Tiburon saw 21% rise in media price and the more wooded area of Kentfield saw 16% growth. Sausalito, sometimes an alternative neighborhood for San Franciscan's saw 8% growth. Larkspur experienced a 33% increases in the number of homes sold, but that drove it's median sales price down by 37%. Stinson Beach numbers took a swing in the other direction (down 26.9%), but this market has so few sales, we take these numbers with a grain of salt as almost every sale can have a major impact on the market in either direction.

San Rafael continued its growth spurt (4%), but we did notice a little thaw in properties above the $1.2 million mark in San Rafael. Buyers seem to have hit a threshold of what they are not willing to go beyond in general, perhaps weighing that against comparable properties in markets closer to San Francisco.

It does appear that the farther north you go, the less "over asking" price you need to pay. Some properties in San Francisco, for instance, can be up bid by two, three, $400,000 or more. In Marin, we play in the tens of thousands whereas Sonoma County may be just in the few thousands -- speaking generally, of course. Property pricing and value varies from house to house, city by city. We do know that Marin buyers have started heading north for more affordability, though Petaluma and Novato don't seem like the bargains they once were.

Average price per square foot in Marin varies from city to city, but the overall average is $738 per square foot. The luxury market starts at about $1,000 per square foot.

Marin Average Month's Supply of Inventory

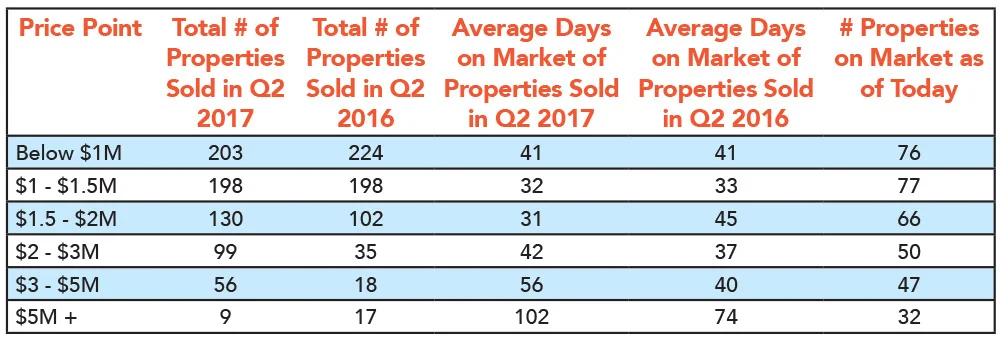

With less properties on the market under one million dollars, and most of those in San Rafael and Novato, we are seeing even more competition in this entry level market. $1 to $1.5 million market is almost exactly where it was a year ago, but big gains in the $1.5 to $2 million market, which has really popped, showing that buyers are willing to jump up to that next level to get what they want. Check out the days on market... drastically reduced while the number of properties sold increased about 22 percent. The $2-3 million price point experienced modest growthand while it took longer for properties in the $3-5 million range to sell from last year, there was a whopping 37% more home sold in this range. Properties above the $5 million range reduced their sold numbers by almost 50% quarter over quarter.

Breakdown of Sold Marin Properties by Price Point Q2 2017 vs. Q2 2016

Buyers most likely to prevail in a multiple offer situation are those have been beaten out of there last couple of tries and are determined to get it right this next time. City buyers also come in more aggressive, expecting over-bids to go higher than they actually do.

Don't underestimate the value of a good pull-on-the-heart-strings letter as well. Buyers are spilling their guts to appeal to sellers and sometimes that can outshine a higher offer. In the end though, money usually talks louder than a letter, but hey... it's worth a try!

Stabilizing prices will require either an increase in inventory, a decrease in demand, or some combination of the two. With interest rates at historic lows and expect to increase only .4% in the next year, demand will likely remain strong. Unless more owners decide that it is time to sell, expect prices to continue to rise -- although at a slower rate than during the 2010-2014 run up. Mortgage buyer Freddie Mac said this past week after the long-term interest rates rose that the rate on 30-year fixed rate mortgages increased to an average 4.3 percent from 3.96 percent. It stood at 3.42 percent a year ago and averaged a record low of 3.65 percent in 2006 according to the San Francisco Chronicle.

With prices continuing to rise, inventory scarce and interest rates inching up, the market continues to forge ahead. But, with what fervor or intensity we are still not sure. Expect a traditional uptick in inventory in the fall, but for some reason that never seems to be as much as we hope. With the demand still strong, there is pressure for prices to continue to rise, but there is always a threshold where enough is enough and we are waiting for signs of that. Perhaps slowing in some price points is an early indicator, but that could also just be a pause or temporary respite, so stay tuned. More news and projections next month! In the meantime, enjoy this wonderful weather!

The Costa Group provides extraordinary service to elevate your life and bring you home. We have an intimate knowledge of the City of San Francisco and the Marin County neighborhoods and amenities. We are your partners, in listening, understanding and negotiating for you with our 30+ years of experience. Allow us to help you buy, sell or invest in San Francisco, Marin County or Wine Country!